In the following we provide a summary of the Hungarian taxes that may be important to those planning to start a business in Hungary. This primarily refers to taxes related to the acquisition of dividends, employment or the acquisition of real estate for investments.

Corporate Tax

Corporate tax is a tax payable on the profits of a business. Its rate is only 9% which is the lowest in the European Union.

For Hungary, no further tax or contribution liability is due for dividends paid by the Hungarian company to other Hungarian or foreign companies. The avoidance of multiple taxation is governed by international conventions. Hungary has concluded such conventions with more than 80 countries. Read more about tax conventions here.

Local business tax

Tax levied by local governments at rates ranging between 0-2%. The tax rate is determined by the municipalities in a decree. Tax is payable on net income, but many items reduce the tax base. The net income may thus be reduced by the expenses spent for the purchasing of the sold goods, and by the value of the tasks fulfilled by subcontractors, to name only the most significant items. Similarly, such benefits may be provided after investments. Thus, this must always be examined on a case-by-case basis in the light of the activity of the specific business.

In Budapest, the determined tax rate is the maximum 2%, but in the case of many settlements interested in promoting investments, the applied tax rate is 0%. These settlements are particularly popular among high-income businesses, involved in haulage and freight forwarding.

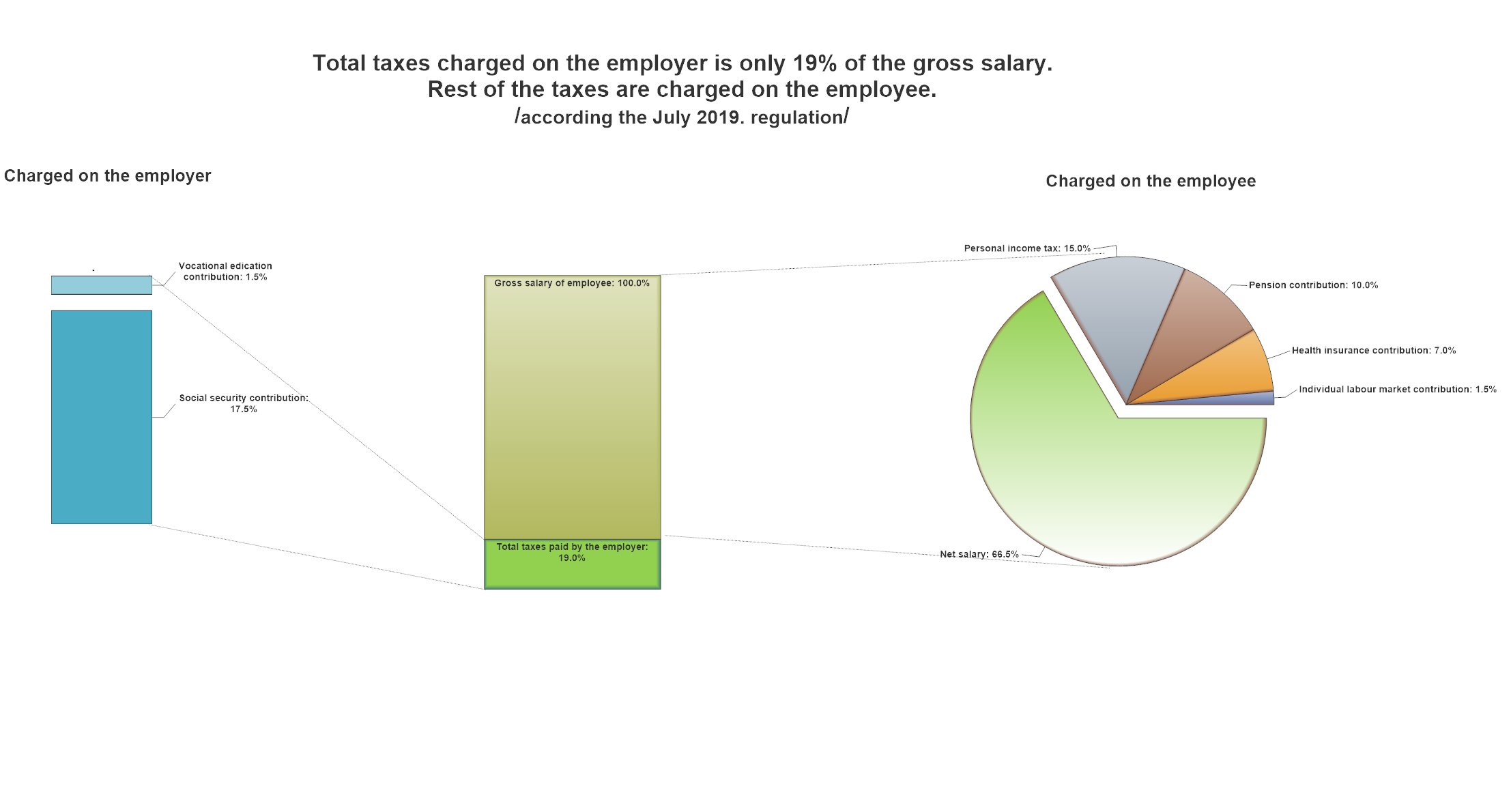

Composition of taxes on wages

In Hungary, wage bargaining revolves around gross wages. In the figure below, the employer’s tax liability over gross wages can be seen. Additional taxes are deducted from the gross wage negotiated by the employee and the employer.

Value Added Tax

The standard rate of the VAT is 27%. This is a high rate, but at the same time it is not an important factor for businesses, since the VAT paid by the company to others within the price of the service/product can be deducted or refunded from the payable tax.

Examining the cost of living, the internet service or basic foodstuff is taxed at a lower rate of 18%-os and 5% respectively.

Despite the high VAT rate, Hungary can be an ideal country for services supplied electronically to European consumers, as in case of consumers, the applicable VAT rate is that of the country of the consumers’ domicile, irrespective of the European country in which the business is established. This way, low taxes on businesses can be fully exploited.

Tax on asset transfer

It is primarily relevant in case of real estate acquisition. As a general rule, the tax on asset transfer for contribution is 4% of the purchase price.

If a business for example, wants to sell or invest in real estate in a commercial way, then different, more favourable rules apply.

Important note

Under tax rules, we have presented the general rules.

However, as it might be evident from the example of asset transfer tax, specific tax planning can only be carried out in the knowledge of the business and the intended activity.